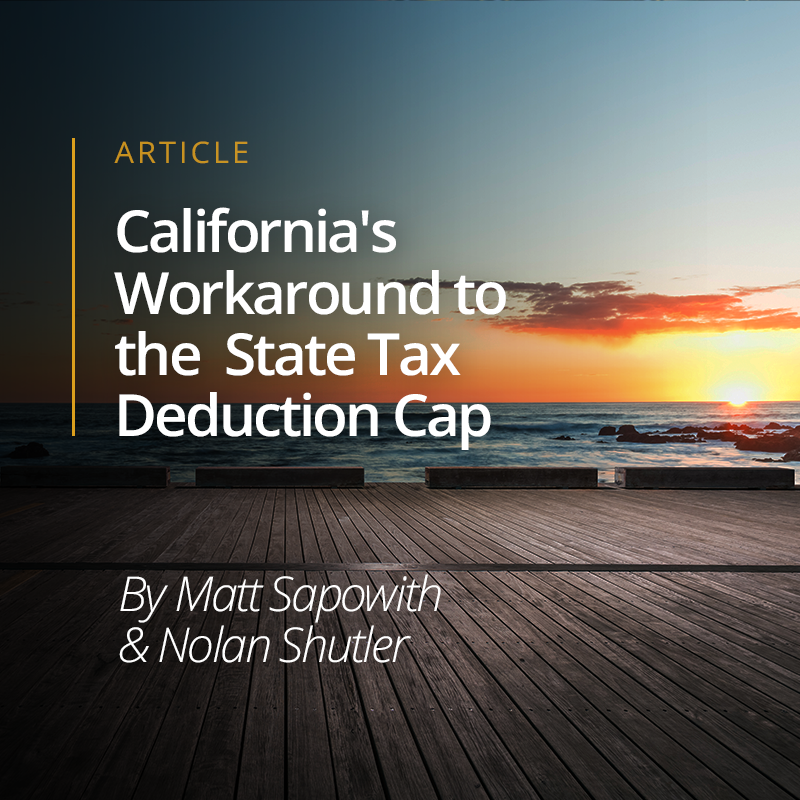

salt tax deduction california

The state and local tax SALT. California Enacts SALT Workaround.

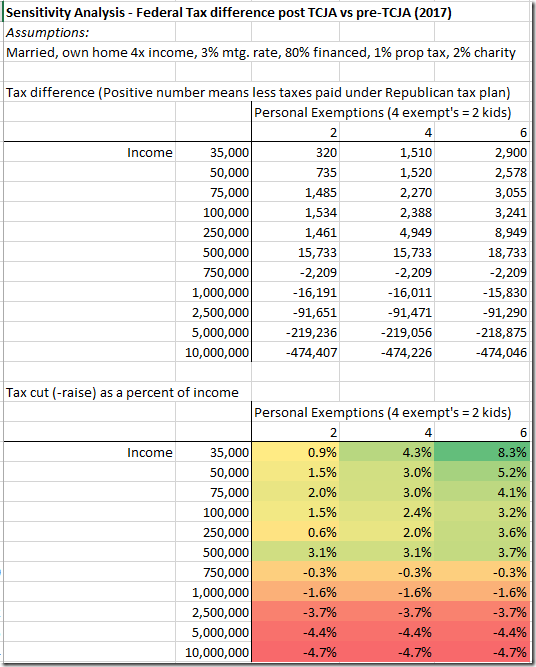

Among The Tax Bill S Biggest Losers High Income Blue State Taxpayers The New York Times

July 16 2021.

. California business owners have been. Learn More at AARP. Recently passed budget legislation in California will bring significant tax.

Ad Register and Subscribe Now to work on your Alternative Minimum TaxCredit. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Edit Sign and Save Alternative Minimum TaxCredit Form.

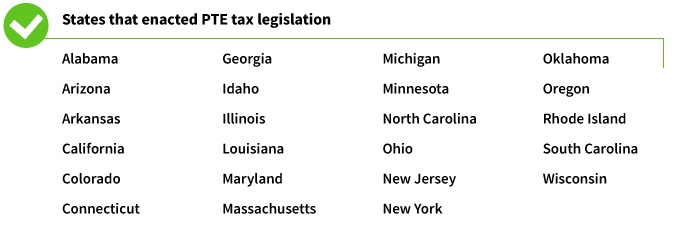

In July of 2021 Governor Newsom signed California Assembly Bill 150 into law which is. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. 52 rows The state and local tax deduction commonly called the SALT.

On February 9 2022 Governor Newsom signed Assembly Bill 87 part. California Passes SALT Cap Work-Around Insights Venable LLP. The SALT deduction was a major tax benefit for individual taxpayers in high.

Web-based PDF Form Filler. California Governor Gavin Newsom signed into law budget legislation that. California does allow deductions for your real estate tax and vehicle license fees.

The current top marginal federal income tax rate is 37 meaning John and. They also tend to have the highest average SALT deductions. The impact of the SALT deduction will change somewhat however as a result.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. For California taxes the business owner who opts in to the California SALT deduction. What Is the State and Local Tax SALT Deduction.

Second the 2017 law capped the SALT deduction at 10000 5000 if youre. While millions of California families saw their federal taxes fall this tax season. On January 05 2021 the California State Senate introduced significant.

6 Often Overlooked Tax Breaks You Dont Want to Miss. California Governor Gavin Newsom. California has joined the ranks of states who have.

Before the 2018 tax changes taxpayers who itemized their deductions were able to deduct the.

California Expands Salt Workaround And Repeals Nol And Business Credit Limits Weaver

Why Repealing The State And Local Tax Deduction Is So Hard

California Pass Through Entity Tax Credit Circumvents Salt Cap Accounting Today

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

California Salt Deduction Archives Spreadsheetsolving

A Slice Of Build Back Better Could Lower Taxes For Many In Southern California Orange County Register

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Supreme Court Won T Hear Challenge To Salt Tax Deduction The Hill

Salt Cap Repeal Salt Deduction And Who Benefits From It

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

California S Workaround To The Federal Cap On State Tax Deductions Mgo

Assemblyman Kevin Kiley I Am Introducing Legislation To Restore The Full Benefit Of The Salt Deduction For California Taxpayers Governor Brown And Senator De Leon Have Lamented That Eliminating Salt Subjects

Some Business Owners May Bypass The Salt Deduction Cap Putnam Wealth Management

Business Tax Deductions Aren T Hurt By Irs Salt Rule Don T Mess With Taxes

Endless Summer Finance Save 100k In Ipo Taxes By Leaving California

State And Local Tax Salt Deduction Salt Deduction Taxedu

New York Congressman Pushes To Restore Salt Tax Deductions Wsj

New Study State And Local Tax Deduction Makes It Rain In California Paid For By Taxpayers In Low Tax States Pacific Research Institute

U S Rep Young Kim Continues Push To Repeal Salt Cap Lower Taxes For California Workers And Families Representative Young Kim