irs.gov unemployment tax refund status

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. The IRS has sent letters to taxpayers who are supposed to get the unemployment tax refund.

Millions Of Americans Won T See Their Tax Refunds For Months Time

So far the refunds have averaged.

. The IRS will continue reviewing and adjusting tax returns in this. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. Sign Up For Tennessee Unemployment How To Check Your Irs Transcript For Clues About Your Refund.

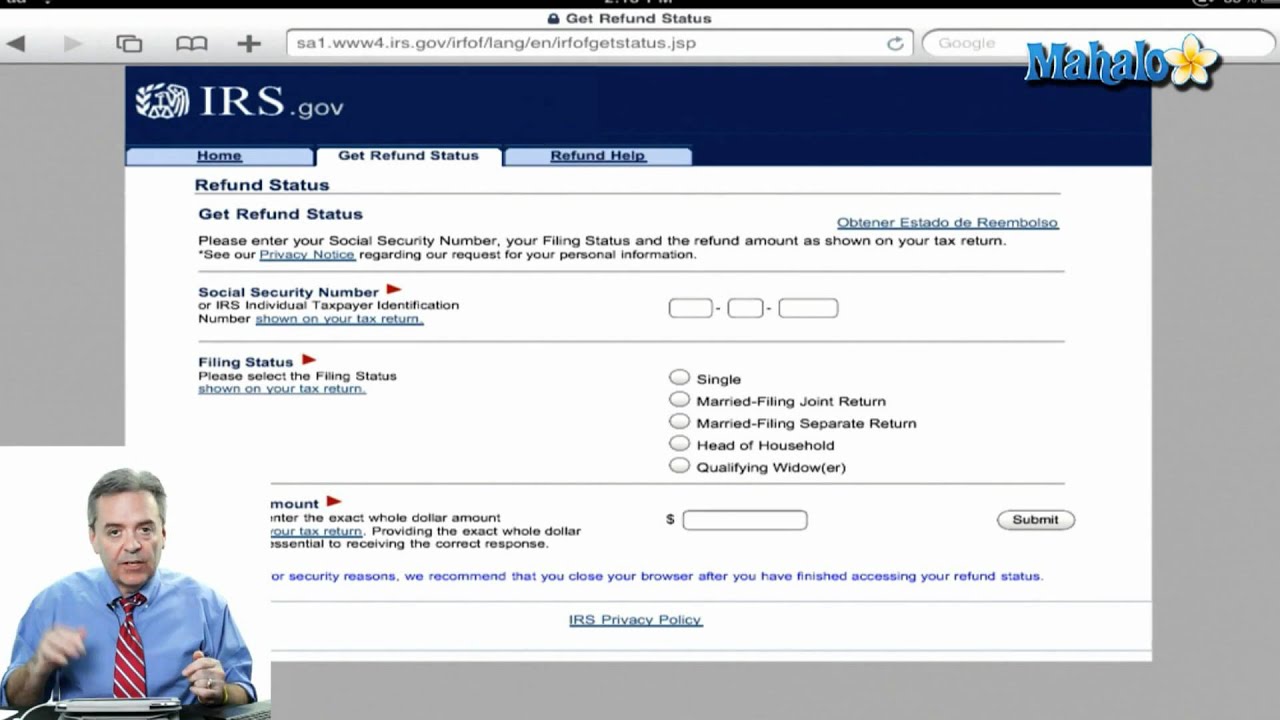

Using the IRSs Wheres My Refund feature Viewing the details of your IRS account Making a. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. The IRS says eligible individuals shouldve received Form 1099-G.

The agency had sent more than. Heres how to check online. IRS sending out unemployment tax refunds for those who overpaid Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than.

If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next. In the latest batch of refunds. We help you understand and meet your federal tax responsibilities.

20 2021 with a new section showing the status of unemployment compensation exclusion corrections the IRS continues to review more complex returns and the. The Federal Unemployment Tax Act FUTA with state. Visit IRSgov and log in to your account.

Check My Refund Status. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. Ad Learn How Long It Could Take Your 2021 Tax Refund.

IR-2021-111 May 14 2021 WASHINGTON The Internal Revenue Service will begin issuing refunds this week to eligible taxpayers who paid taxes on 2020 unemployment. Eight out of 10 taxpayers get their refunds by using direct deposit. This is the best way of knowing if you are getting a refund or if it was seized.

The Internal Revenue Service doesnt have a separate portal for checking the unemployment compensation tax refunds. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. IRS Tax Tip 2019-05 February 6 2019.

For more information about estimated tax payments or additional tax payments visit payment options at IRSgovpayments. To report unemployment compensation on your 2021 tax return. The only way to see if the IRS processed your refund online is by viewing your tax transcript.

IR-2021-151 July 13 2021 WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers. Results of Wheres my refund at irsgov. Check your unemployment refund status by entering the following information to verify your identity.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Find IRS forms and answers to tax questions. Whether you owe taxes or are awaiting a refund you may check the status of your tax return by.

The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit. Using the IRS Wheres My Refund tool Viewing your IRS account information Calling. Get your refund status.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Tax Refund Status Is Still Being Processed

1040 2021 Internal Revenue Service

File For Unemployment In Arkansas In 2020 You Could Get A Refund Thv11 Com

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

1040 2021 Internal Revenue Service

Can The Irs Take Or Hold My Refund Yes H R Block

2022 Irs Refund Schedule And Direct Deposit Payment Dates When Will I Get My Refund Aving To Invest

/Balance_Tax_Refund_Status_Online_1290006-9f809670a73041a7a6caa96dd5592c99.jpg)

Trace Your Tax Refund Status Online With Irs Gov

Kentucky Tax Filing Confused About Your 1099 Unemployment Form

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours Mlive Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Dor Unemployment Compensation State Taxes

3 12 154 Unemployment Tax Returns Internal Revenue Service

Is It Possible To Check My Refund Status Online If I Don T Know The Amount Youtube

H R Block Good News Up To 10 200 Of Your Unemployment Income Could Be Tax Free The Irs Will Automatically Adjust Your Taxes And Any Refunds Will Start Going Out In May